In a groundbreaking move echoing through the corridors of high-stakes real estate, Bright Ruby Resources, backed by Chinese tycoon Du Shuanghua, has made waves with its successful bid for an en bloc redevelopment site along Singapore’s famed Orchard Road. The reported deal, valued at a substantial US$667 million (S$908 million), stands as the largest collective sale in the city-state this year, reflecting a dynamic shift in the real estate landscape amidst challenging market conditions.

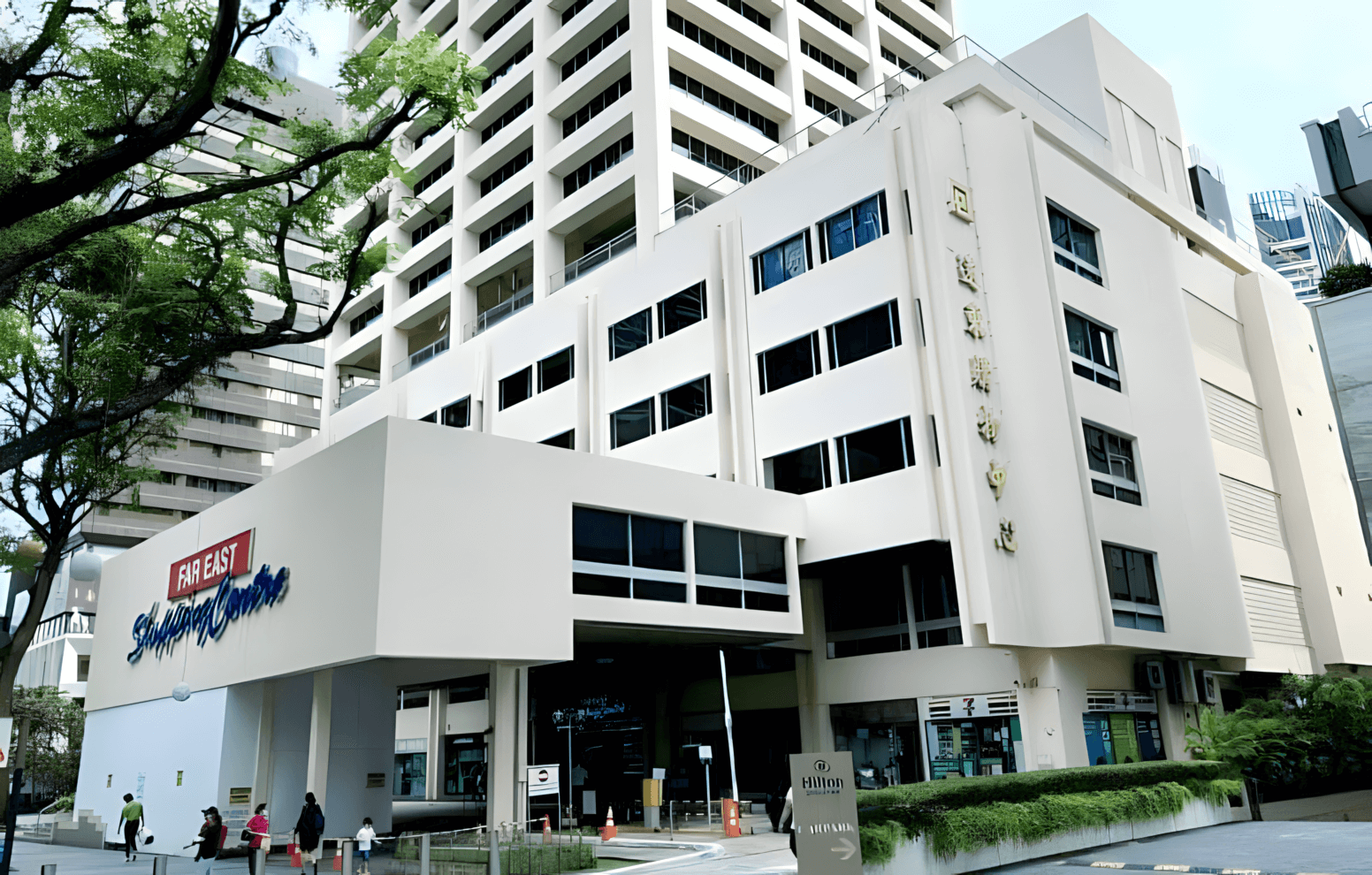

Situated at the nexus of Orchard Road and Angullia Park, the Far East Shopping Centre commercial complex has become the centre of attention following Bright Ruby’s agreement with the property owners. This en bloc acquisition, which awaits the nod from the Strata Titles Board for finalization, underscores the investment firm’s strategic foray into the vibrant heart of Singapore’s retail and commercial hub.

The reported acquisition cost of US$667 million is a testament to Bright Ruby’s commitment to strategic investments in Singapore. It’s worth noting that this transaction closely follows Bright Ruby’s high-profile S$1 billion acquisition of the 16 Collyer Quay office tower in Raffles Place in July of the preceding year, showcasing the firm’s appetite for substantial and strategic real estate ventures.

If the reported deal value of S$908 million stands true, this transaction will not only be a testament to Bright Ruby’s financial prowess but will also etch its name in the record books as the most substantial collective sale in Singapore for the year. This comes when the joint sale market in the city-state has faced headwinds due to new levies on residential sales and rising interest rates.

In terms of rates, the reported S$33,609.65 per square metre for the maximum buildable area signifies the weight of the deal. The 36,014 square metre 999-year leasehold site, currently hosting the Far East Shopping Centre, is set for a potential transformation under Bright Ruby’s ownership.

Bright Ruby’s winning bid has opened the doors to redevelop the five-decade-old Far East Shopping Centre into a mixed-use marvel spanning up to 290,574 square metres. Should it qualify for the bonus floor area granted to commercial buildings under Singapore’s Strategic Development Incentive (SDI) scheme, this ambitious undertaking could reshape the Orchard Road skyline.

Michael Tay, Head of Singapore Capital Markets for CBRE, the firm that managed the tender, envisions a versatile development encompassing retail spaces, hotels, offices, MICE facilities (meetings, incentive, convention, and exhibition), and lifestyle amenities. This transformative vision aligns with Singapore’s broader urban redevelopment plans, emphasizing the integration of modern commercial projects with residential spaces.

Bright Ruby faces the regulatory hurdle of engaging in a joint redevelopment project with at least one neighbouring property to qualify for Singapore’s SDI scheme. Whether it’s the Voco Orchard Singapore hotel owned by Ong Beng Seng’s Hotel Properties Ltd or Liat Towers owned by SGX-listed Bonvests Holdings, the aim is to encourage larger-scale projects that contribute to the revitalization of Orchard Road.

The URA’s (Urban Redevelopment Authority) master plan envisions a rejuvenated Orchard Road, transforming it into a tree-lined green corridor featuring modern commercial projects seamlessly blended with residential spaces. Far East Shopping Centre, developed by the Far East Organization in 1974 for a modest S$20 million, has stood witness to the evolution of Orchard Road into Singapore’s premier shopping destination. With over 600 stories across its five-storey retail podium and ten floors of office units, its redevelopment under Bright Ruby’s ownership could mark a new chapter in Orchard Road’s illustrious history.

In a year characterized by relative quietude in the collective sales market, Bright Ruby’s acquisition stands out alongside Aurum Land’s notable S$66.8 million purchase of the Kew Lodge townhouse complex in District 11. This marks a departure from earlier in the year when UOL Group and its subsidiary Singapore Land Group led the collective sale stakes with their S$392.2 million purchase of the Meyer Park condo project in February.

The collective sale market’s subdued nature can be attributed to the challenging market conditions influenced by new levies on residential sales and rising interest rates. Bright Ruby’s successful foray into this landscape reflects resilience and strategic acumen in navigating the intricacies of Singapore’s real estate market.

Bright Ruby, controlled by Du Shuanghua through multiple entities, has strategically positioned itself in Singapore’s real estate arena. The private investment firm’s all-cash purchase of the 16 Collyer Quay office tower in July of the preceding year signalled a notable entry into the city-state’s high-stakes real estate game.

Du Shuanghua, a mining magnate with a complex history, has demonstrated a keen interest in diversifying his investments. Bright Ruby’s recent ventures underscore a shift towards real estate as a strategic avenue for wealth preservation and growth.

As Bright Ruby Resources awaits the final approval from the Strata Titles Board, the city-state holds its breath for the potential transformation of the iconic Far East Shopping Centre. The reported US$667 million acquisition is more than a record-breaking deal; it is a testament to the resilience and strategic foresight of Bright Ruby Resources in navigating the complexities of Singapore’s real estate market.

If the regulatory hurdles are overcome, Orchard Road could witness a renaissance under Bright Ruby’s stewardship, contributing to the broader vision of Singapore’s urban redevelopment. This real estate odyssey serves as a reminder that, in the world of high-stakes deals, some entities are not just buying properties; they are shaping the future landscape of iconic cityscapes.